Foxconn makes $208 billion a year. Their profits just jumped 91%. And they’re turning away business.

That’s how crazy hardware development has become. The semiconductor market hit $697 billion this year, racing toward $1 trillion by 2030. Everyone needs custom chips, AI accelerators, and quantum processors. Nobody can build them fast enough.

I spent the last month digging into over 200 hardware development companies. Not their marketing slides or press releases – actual client projects, delivery times, failure rates. Talking to CTOs who’ve bet their companies on hardware that may or may not arrive. Visiting facilities where the future either ships on time or destroys quarterly earnings.

Five companies kept coming up. The ones actually delivering while everyone else makes excuses about supply chains and talent shortages.

The Silent Crisis

Taiwan makes 90% of advanced chips. One island. One company – TSMC. The entire tech industry depends on factories that sit 100 miles from China.

The US throws $190 billion at domestic chip production through the CHIPS Act. Intel promises American manufacturing. TSMC builds a facility in Arizona, supposed to open in 2025. Now delayed to 2028. Samsung’s Texas plant faces the same delays. Turns out you can’t just copy Taiwan’s ecosystem.

Meanwhile, every company needs custom hardware. AI chips for data centers. Quantum processors for research labs. Edge computing devices for retail stores. Medical devices that require FDA approval. Automotive systems that can’t fail.

The talent doesn’t exist. The industry needs one million additional engineers by 2030. Universities graduate maybe 50,000 annually worldwide. Companies are stealing each other’s engineers with ridiculous salary offers while projects pile up unfinished.

One startup CEO told me last week, “We designed an amazing AI chip. Can’t build it. Our manufacturer has a 14-month backlog. By the time we ship, our design will be obsolete.”

The companies below figured out how to navigate this mess. They’re not just surviving. They’re thriving while competitors drown in complexity.

Yalantis – The Company That Makes Hardware and Software Actually Work Together

Yalantis shouldn’t be on this list. They’re a 500-person engineering firm across Poland, Ukraine, Cyprus, and Estonia. They don’t manufacture chips or build supercomputers.

But they solve a problem that destroys most hardware projects: making hardware and software work together.

This sounds simple. It’s not. I’ve watched dozens of projects fail because the hardware team and software team don’t talk. Or they talk but don’t understand each other. Or they understand each other but work on different timelines.

Yalantis handles everything through their hardware development services. PCB design, prototyping, firmware development in Rust and C++, cloud integration, regulatory compliance. One team, one timeline, one point of contact.

A medical device startup CEO explained why this matters. “We tried the traditional approach. Hardware vendor designed boards. Software contractor wrote firmware. Cloud team built the backend. Nothing worked together. Eight months wasted. Yalantis rebuilt everything from scratch in six months. It passed FDA approval on the first try.”

Their secret weapon is Rust expertise for embedded systems. Rust prevents memory bugs that plague IoT devices. As everything becomes connected, security becomes critical. Most embedded developers can’t write Rust effectively. Yalantis can.

They’ve maintained 96% customer satisfaction over 17 years. Clients include Toyota, Bosch, and Google X. Not bad for a company most people have never heard of.

Projects typically run $200,000 to $2 million. That’s not cheap. But for complex hardware-software integration, especially in regulated industries, they deliver when separated teams fail. One automotive client told me, “We spent $300K with Yalantis. It saved us $1 million in integration headaches.”

Foxconn – The $208 Billion Giant Nobody Understands

Everyone knows Foxconn makes iPhones. What they don’t know is that Foxconn has become the backbone of AI infrastructure, with AI server revenue now representing 40% of their server business.

They operate 230+ campuses across 24 countries. When chip shortages destroyed everyone else’s plans in 2021-2022, Foxconn kept shipping. Why? They control more of the supply chain than anyone except maybe Samsung. Components, assembly, logistics, everything happens within their ecosystem.

Their Taoyuan facility just earned the world’s first AI server Lighthouse certification. Translation: they’ve figured out how to mass-produce AI hardware when everyone else struggles with prototypes.

A startup founder who manufactures through Foxconn explained the real advantage. “We designed a new AI accelerator. Complicated design, lots of custom components. Foxconn had prototypes in three weeks, production samples in six weeks, and volume production in four months. Our previous manufacturer quoted 18 months.”

But Foxconn isn’t for everyone. Minimum orders start at 10,000 units for most products. Customer service focuses on accounts worth millions. One small hardware company told me, “We had a quality issue affecting 500 units. Foxconn took three months to respond. For them, 500 units is a rounding error.”

Their sweet spot remains high-volume consumer electronics and AI infrastructure. If you’re Apple or Microsoft, Foxconn delivers miracles. If you’re a startup with a great idea and small orders, look elsewhere.

Cerebras – A Company That Built an Impossible Chip

Cerebras built a processor the size of a dinner plate. Their Wafer Scale Engine contains 4 trillion transistors and 900,000 AI cores. One chip. No cutting the wafer into smaller dies like everyone else.

This violates everything about chip manufacturing. Wafers have defects. You cut around them, discard the bad parts. Cerebras said forget that. They built redundancy into the design, routing around defects automatically. The entire wafer becomes one functional processor.

The results are absurd. Their CS-2 system replaces hundreds of GPUs for certain AI workloads. Los Alamos National Laboratory uses them for climate modeling. GlaxoSmithKline uses them for drug discovery. Training that took months now takes weeks.

But here’s the catch. One system costs $2 million. You need specialized cooling and power infrastructure. The programming model differs completely from standard GPU clusters.

An AI researcher at a major university told me, “Cerebras is 10x faster for our simulation workloads. But it took six months to port our code. Half my team quit rather than learn the new system. Was it worth it? Yes. Would I recommend it to others? Only if they have very specific needs and deep pockets.”

Cerebras solves problems nobody else can solve. If you’re pushing the absolute limits of computation and have millions to spend, they deliver capabilities that don’t exist elsewhere. For 99% of companies, it’s expensive overkill.

Flex – Hidden Infrastructure Giant

Flex generates $30 billion annually, building the infrastructure everyone else depends on. While competitors fight over chip design, Flex quietly bought every company needed for AI infrastructure.

They acquired Anord Mardix for power distribution. Crown Technical Systems for cooling. JetCool Technologies for direct-to-chip cooling. In 18 months, they assembled the complete stack for AI data centers.

NVIDIA depends on Flex. When Jensen Huang talks about AI factories, Flex builds the actual factories. Not the chips – the power systems, cooling infrastructure, and rack integration that make 100kW deployments possible.

A data center operator in Texas told me their Flex story. “We needed to retrofit for liquid cooling. Three companies bid. Two said 8-10 months. Flex said four months and delivered in three and a half. They designed it, built it, installed it, and it actually worked.”

Flex occupies the sweet spot between custom engineering and mass production. Minimum orders typically start around 1,000 units, but they’ll tackle complex integration projects that Foxconn won’t touch.

The company doesn’t get headlines because infrastructure is boring. But as compute density increases and cooling becomes critical, Flex’s expertise becomes invaluable. They understand the unglamorous but essential systems that keep modern hardware running.

Alice & Bob – One of the Few Quantum Companies That Might Actually Deliver

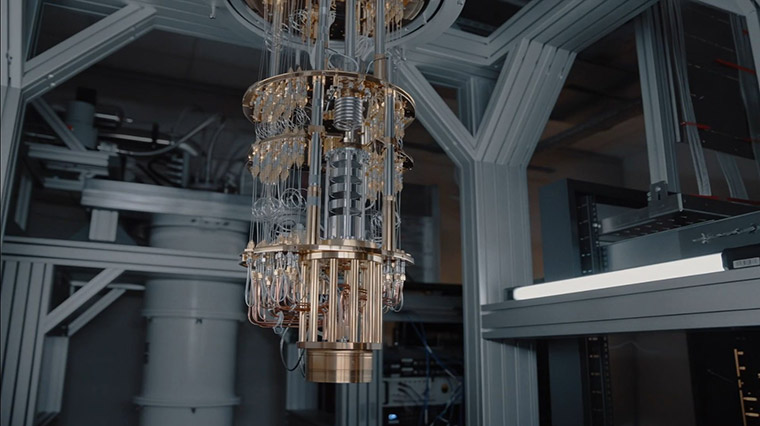

Everyone’s building quantum computers. Google, IBM, Amazon – billions spent, little to show for it. Alice & Bob, a French startup, just raised $104 million because they might have solved the biggest problem in quantum computing.

Their innovation sounds simple, but it isn’t. Traditional quantum bits (qubits) are incredibly fragile. A cosmic ray, a vibration, even a stray magnetic field destroys calculations. Everyone else tries to fix this with thousands of error-correcting qubits. Alice & Bob built qubits that inherently resist the most common errors.

They call them cat qubits, based on Schrödinger’s cat thought experiment. The physics is mind-bending, but the result is simple: their qubits are naturally stable against bit-flip errors, the most common type of quantum error.

Their Helium 1 chip has 16 qubits. Not impressive compared to IBM’s 1,000+ qubit systems. But Alice & Bob’s qubits actually work reliably. They’re targeting 100 logical qubits by 2030. If they succeed, that’s more computational power than all current quantum computers combined.

A quantum researcher at CNRS told me, “Everyone’s adding more qubits, like adding more engines to a plane that can’t fly. Alice & Bob redesigned the wings.”

But we’re still years from commercial applications. Today’s customers are research institutions and government agencies exploring quantum’s potential. Programming requires PhD-level expertise. Real products remain theoretical.

If quantum computing achieves its promise – breaking encryption, designing new materials, and discovering drugs – early adopters will have massive advantages. Alice & Bob offer one of the more credible paths to that future. Just don’t expect to buy a quantum computer this year.

Who Should You Actually Work With?

Need millions of units manufactured? Foxconn remains unmatched. They’ll deliver consistent quality at scale. Just don’t expect customization or hand-holding for small orders.

Pushing computational boundaries? Cerebras offers capabilities nobody else has. Budget millions and prepare for a learning curve, but the performance gains can be transformative.

Building AI infrastructure? Flex understands the complete system – power, cooling, integration. They’re not sexy, but they’re essential.

Betting on quantum’s future? Alice & Bob present one of the more credible approaches. Their error-resistant qubits could make quantum computing practical years ahead of competitors.

Need hardware and software that actually work together? Yalantis delivers integrated solutions when separated teams fail. Not cheap, but they finish projects.

Avoid companies promising revolutionary breakthroughs without working products. The hardware industry is littered with great PowerPoints and dead startups. Look for proven delivery, not clever designs.

Be skeptical of anyone claiming easy solutions to chip shortages or supply chain issues. These problems are structural. They’re getting worse, not better.

What Happens Next

The hardware development industry in 2025 sits at an inflection point. AI demand drives unprecedented growth. Geopolitical tensions threaten everything. Talent shortages constrain expansion.

Traditional manufacturers like Foxconn evolve into AI infrastructure providers. Specialists like Cerebras push computational boundaries that seemed impossible five years ago. Quantum companies race toward practical systems. Integrators like Yalantis bridge the growing hardware-software divide.

The winners won’t be the biggest or most innovative. They’ll be the ones who consistently deliver despite chaos. In an industry where a single delayed chip can destroy a product launch, execution matters more than vision.

As one CEO told me while showing me their graveyard of failed hardware projects, “Everyone has amazing technology roadmaps. Show me who actually ships products on time. That’s your real top five list.”

The companies above consistently ship. In 2025’s hardware development environment, that’s what separates leaders from the very long list of companies with great ideas and empty promises.

Thomas Hyde

Related posts

Popular Articles

Best Linux Distros for Developers and Programmers as of 2025

Linux might not be the preferred operating system of most regular users, but it’s definitely the go-to choice for the majority of developers and programmers. While other operating systems can also get the job done pretty well, Linux is a more specialized OS that was…

How to Install Pip on Ubuntu Linux

If you are a fan of using Python programming language, you can make your life easier by using Python Pip. It is a package management utility that allows you to install and manage Python software packages easily. Ubuntu doesn’t come with pre-installed Pip, but here…